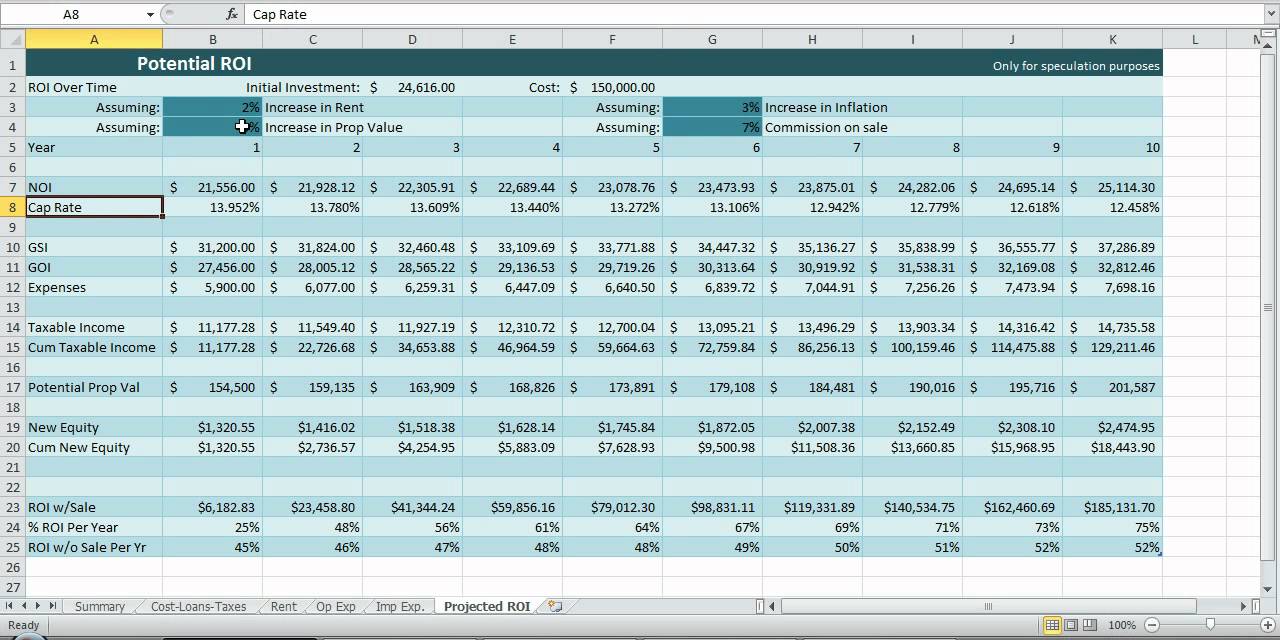

For example, if your property generates $100,000 per year in total rental income and annual operating expenses are $45,000, the NOI is $55,000. You will also want to consider vacancies based on historical vacancy or projected performance once the property is leased up.Īfter you have your properties’ total income and expenses, subtract the operating costs from the rental income. Then, you will want to add up the property’s expenses such as repairs, legal costs, property taxes, property management fees, etc. When adding the total of your property’s income, you can include any revenue type, such as fees, rental income, and amenities that tenants pay extra for. The first step in calculating cap rate is determining the net operating income or NOI by subtracting operating expenses from rental income. There are three steps to follow when calculating the cap rate in commercial real estate. If you inherit the property, there is no building cost, so you need to divide the current asset value by the NOI for the most up-to-date cap rate. NOI does not include debt service, depreciation expense, or owner’s expenses such as periodically traveling to the property. Net operating income is the amount of money you expect to receive for the year after all rents have been collected and all operating expenses have been paid. Net Operating Income (NOI) / Property Price or Market Value = Cap Rate.Real estate investors determine the cap rate by applying a formula: What is Cap Rate?Ī real estate cap rate is based on the amount of risk and potential income one property has compared to others. Instead, it just gives a snapshot of a specific period in time. The cap rate also does not provide a return rate for the investment’s life cycle. Instead, the cap rate is simply an insight into how long it will take to earn back the money you initially invested into the property. It is essential to know that the cap rate does not provide a return on investment or ROI. The cap rate is most beneficial when there are constant sales to compare and evaluate the costs to see if the offer price is reasonable. You can find out your capitalization rate by dividing the property’s net operating income (NOI) by the market value of the property. The capitalization rate, or the cap rate, is a way to figure out the rate of return that you expect to generate on your real estate investment property.

0 kommentar(er)

0 kommentar(er)